BDF Liquidity Planning Cockpit

SAP-integrated liquidity planning with BDF’s LPC

Plan your liquidity fully integrated in SAP with BDF‘s Liquidity Planning Cockpit (LPC). The LPC lets you establish individual planning structures and periods and collect planning data. Information from various areas is automatically derived and allocated to the respective liquidity positions.

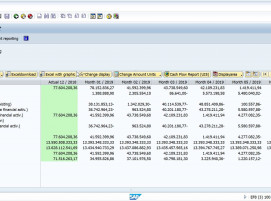

- Management Reporting (e.g. actual/plan, plan/plan)

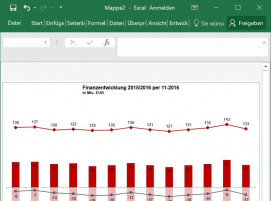

- Graphical Output

- Downloading and uploading functions for data from parties without SAP access

- Automated transfer of planning data into Exposure Management

- Intercompany coordination thanks to the mirroring of planning information

- Integration of accounts payable, accounts receivable, open items, and treasury information

Using the LPC under S/4 HANA

Our future-oriented LPC ensures unrestricted use under SAP S/4 HANA. To improve user experience and provide mobile access, our reporting solution is based on fiori apps that can be utilized in SAP S/4 HANA as well as SAP ERP. Feel free to contact us for a live demo.

LPC Highlights

Deep Integration

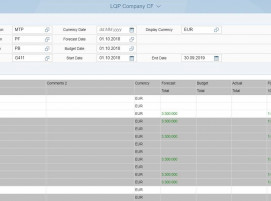

Access your entire data transparently and at a glance, thanks to the deep integration of our Financial Supply Chain and Cash Position Cockpit in the SAP modules. Focus on your liquidity planning without having to worry about the accuracy and acquisition of required data. The results of your liquidity planning will be automatically stored and made available for cash disposition. Direct integration into the SAP-Exposure Management enables the targeted management of foreign currency effects as well as the automated transfer of data from the LPC into the Exposure Management.

Liquidity Monitor

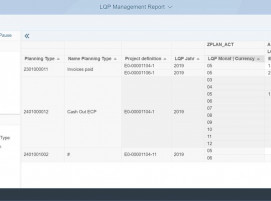

Based on the strategic liquidity planning specifications, the liquidity monitor allows you to set up various company structures within the system for individual or combined planning. Our liquidity monitor lets you check and centrally monitor the respective input or acquisition status. You can also initiate predefined process steps should a party fail to meet planning deadlines.

Catering to individual structures

Thanks to customizable liquidity structures, the LPC can map any business model. Prepare and assess your planning by company code, time frame, organization ID, and planning unit allowing you to easily analyze individual positions.

Comprehensive reports supported by graphics

The LPC provides comprehensive reporting options (see The LPC at a glance). A targeted selection lets you generate customized reporting requirements. The tool also offers plan/actual plan and plan/plan crosschecks helping you compare plans, e.g. from different periods for greater quality control. The plan/actual plan comparison depicts the absolute deviations or percentage of deviation at every planning level. Calculation of your actual figures is based on bank statements or FI information. Some evaluation reports even feature graphics for a selected number of records. Thanks to our cutting-edge technology, you can now create management reporting including graphic value display directly from our LPC.