03.02.2020

Transparent and secure payment processes in SAP

Automatic reports, clear and simplified exposure/liquidity planning and an SAP-integrated payment platform – these were the goals of a toolmaker near Stuttgart.

The toolmaker decided to realise these goals with BDF EXPERTS for two reasons: Firstly, BDF has a wealth of experience in the area of SAP Bank Communication Management (SAP BCM), the SAP-integrated tool for bank communication. Secondly, BDF EXPERTS offers the BDF Liquidity Planning Cockpit (LPC), an SAP-integrated tool for simple and efficient exposure/liquidity planning with direct integration into SAP Treasury and Risk Management.

Setting up a new S/4HANA system

One challenge in the project was that the toolmaker wanted the new software to be implemented without touching the existing financial processes.

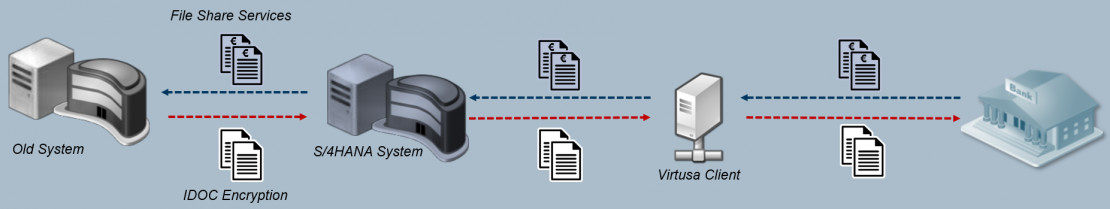

BDF therefore decided to set up a new SAP S/4HANA system in which SAP BCM was implemented. The Virtusa EBICS Client for SAP was selected as the client for data transfer between the SAP system and banks, ensuring fast and secure data transfer using the EBICS standard. BDF also developed a gateway with which the files can be transferred in encrypted form via IDOC between the existing HR and FI system to the new S/4HANA system in a fully automated process.

Concert-wide overview of bank accounts

The release and forwarding to the Virtusa client takes place in the S/4 system. The bank's account statements are also transferred to the S/4 system via the Virtusa Client and then forwarded to the upstream systems via FileShareServices. BDF also set up Bank Account Management in the S/4 system to enable a group-wide overview of bank account balances.

Implementation of BDF Liquidity Planning Cockpit

Following the implementation of BCM, BDF EXPERTS realised the use of the BDF Liqudity Planning Cockpit (LPC) in the second step. Here, a 36-month plan is recorded, the FX exposure is calculated and transferred to SAP Exposure Management at the touch of a button. Based on this data, market risks are analysed (shift, scenarios) and forwarded to Hedge Management. Another aspect of the realisation was the mapping of derivatives, refinancing and investment products in SAP Treasury and Risk Management.

The new S/4 system also enables yield monitoring using Portfolio Analyzer as well as the automated posting and transfer of all cash flows to upstream financial systems. The S/4HANA system thus offers holistic and transparent management and monitoring of cash flows throughout the tool manufacturer's entire organisation.