18.01.2021

The connection of FXall to SAP Treasury and Risk Management

Foreign currency transactions (FX transactions) are traded almost daily at one of Germany's largest wind turbine manufacturers. In order to optimise these trading processes, the wind turbine manufacturer enlisted the help of BDF EXPERTS. With the help of SAP Treasury and Risk Management and the BDF Trading Monitor, the FX trading processes were successfully automated.

Automation of foreign currency transactions

The wind turbine manufacturer trades foreign currency transactions (FX transactions) almost daily using the FXall platform in order to actively manage the operational FX risk from the various companies. Previously, the transactions were entered twice for this purpose, once in FXall and once in SAP Treasury and Risk Management (TRM). In addition, all transactions had to be manually counter-confirmed.

As part of the joint project implementation with BDF EXPERTS, these process steps were automated as far as possible. This means that the business processes only have to be entered or traded once in FXall. Apart from a few previously defined exceptions (e.g. country-specific features in Turkey), all processes now run automatically, with the exception of the subsequent release in the workflow.

FXall and SAP linked for the first time

The exciting part of this project was the first-time connection of FXall to SAP-PI/PO or SAP-TRM, as a link in this form had never been created before. In addition, the processes from FXall did not match the processes from SAP-TRM, which meant that the FXall Settlement Centre had to be used.

In addition, a redesign of the TRM functions recently introduced by another consultancy firm had to be implemented with Focus FX transactions, as otherwise a high level of automation would not have been possible.

BDF Trading Monitor as a solution

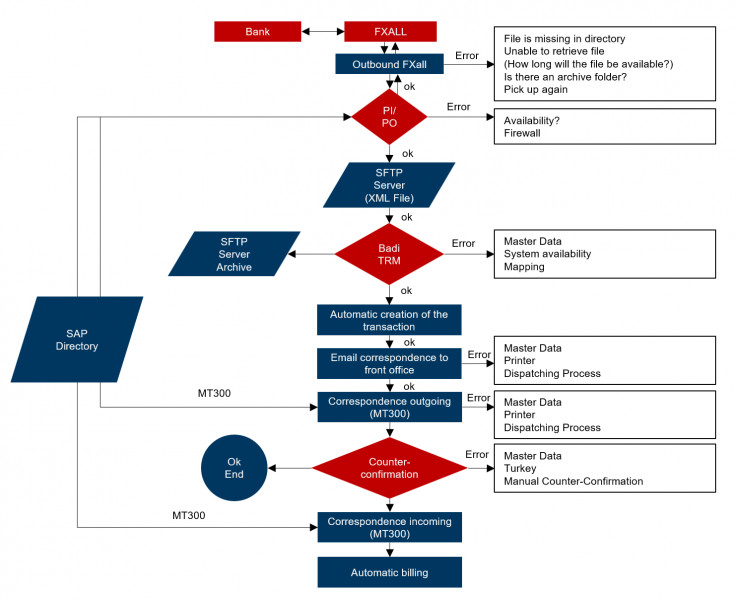

The aim was to ensure that all FX spots and forward transactions traded via FXall are automatically transferred to SAP Treasury and Risk Management via SAP PI/PO. For this purpose, a mapping (e.g. business partner, company code) was set up in SAP ERP between the FXall and SAP data models, which can be maintained by the user.

In order to recognise any errors in the input interface and ensure user-friendly processing, status management and further processing are carried out via the BDF Trading Monitor. This means that incorrect transactions, e.g. incomplete master data, mapping errors can be easily recognised and reprocessed by the user at any time. By using customised fields in FXall, the transactions are correctly classified in SAP-TRM according to HGB/IFRS specifications, e.g. cash flow hedge, valuation unit/no valuation unit, in order to be able to map different accounting requirements. This means that nine different circumstances are managed separately.

If the transactions are created in SAP-TRM, MT300 correspondence is automatically generated, which is also transferred to FXall via SAP-PI/PO. The outgoing correspondence can be tracked and monitored (e.g. status monitoring) via the correspondence monitor.

In the FXall Settlement Centre, the messages from the bank (MT300 counterconfirmation) and the customer's confirmation (MT300) are then compared and reconciled. If the most important information matches, the settlement centre sends the customer's confirmation MT300 message to the bank or the customer receives the MT300 message forwarded by the bank.

In the correspondence monitor, incoming and outgoing messages are automatically matched and the financial transaction is automatically settled if there is a match. If no matching was possible, this situation must be checked manually and corrected accordingly or matched manually.

The transactions are then checked as part of a dual control process and are then ready for posting or for the monthly closing valuation. All present values are calculated for this purpose using the SAP Market Risk Analyser and transferred to the corresponding present value table (automated process). Based on the classification made according to local GAAP, IFRS, HGB, among others, the position management procedures and account assignment references were determined for each accounting standard, behind which the account determination and valuation logic is hidden. Depending on the assigned inventory management method, the present values determined are applied differently to the inventory.

To ensure that this process is also automated and without manual adjustments, the product types were redesigned as part of the project, including accounting integration and evaluation logic. From now on, one product type will be used for all degrees of interconnection (e.g. internal, external) and all classifications. This has also reduced the number of FX product types and increased flexibility, which is in line with the BDF standardised approach. This means that necessary reclassifications can be carried out by means of a valuation class transfer.

By connecting FXall to SAP-PI/PO and SAP-TRM for the first time, the trading of foreign currency transactions could be almost completely automated. This reduces FX risks and optimises cooperation between the Group's individual companies. In addition, the revision makes trading more secure by ensuring that the bank's data matches the SAP system. The wind turbine manufacturer and BDF EXPERTS will continue to work together in 2021. Both in further CRM support and in logistics.