18.01.2024

SAP ICMR

SAP ICMR stands for Intercompany Matching and Reconciliation and is a reconciliation tool for group consolidation. The tool carries out the necessary preparatory work to ensure a harmonized database. SAP has been delivering the solution as standard since the SAP S/4HANA On Premise 1909 release and since the SAP S/4HANA Cloud 1908 release.

What is a typical application scenario for ICMR?

A group's financial accounting records various business transactions on a daily basis. These can result from transactions with external suppliers or customers as well as from intragroup transactions with subsidiaries. Intra-group transactions are relevant for ICMR. These can be, for example, cash transactions such as internal loans, foreign currency transactions or intercompany customer order transactions. Business transactions can be posted both in the SAP system and in an external system. ICMR offers the option of importing data via an interface to the external system or via file upload so that all data can be processed and taken into account. Overall, ICMR has a broad repertoire of Fiori apps that can be used to carry out all the necessary steps for group reconciliation processes.

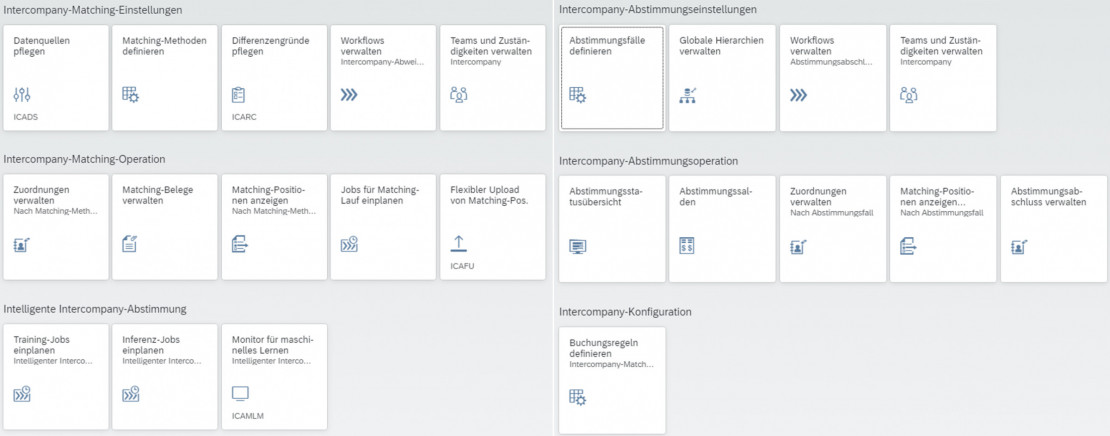

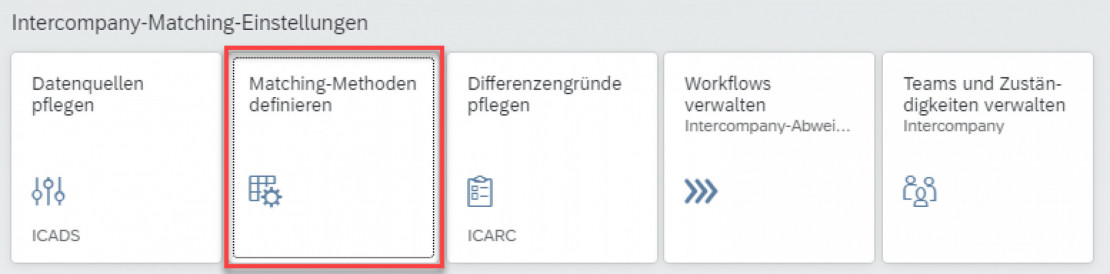

Matching methods & matching rules

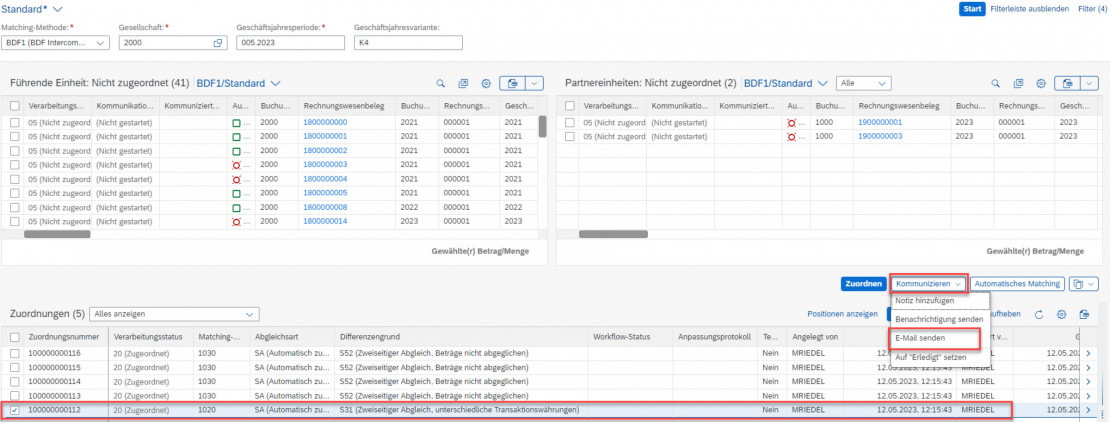

The data from the companies can be clustered with the help of so-called matching methods. These matching methods in turn consist of defined matching rules into which the data is divided. A rule is defined by predetermined conditions. If a condition applies to the imported data record, ICMR automatically assigns it to the matching rule. Manual assignment of data records is also possible.

This clustering enables an effective analysis and processing of recognized differences between the companies. For example, company A can make a posting in euros, while company B inadvertently makes the counter entry in US dollars. In this scenario, the postings would be assigned to matching rule 1020 "Currency codes do not match". In the "Manage assignments" app, you can view the assignments and make manual corrections if necessary. Processing can be triggered by a coupled workflow. For example, the processing group accountant can forward information directly from ICMR to the responsible clerk in the respective company or directly initiate an adjustment posting, which is approved using the dual control principle.

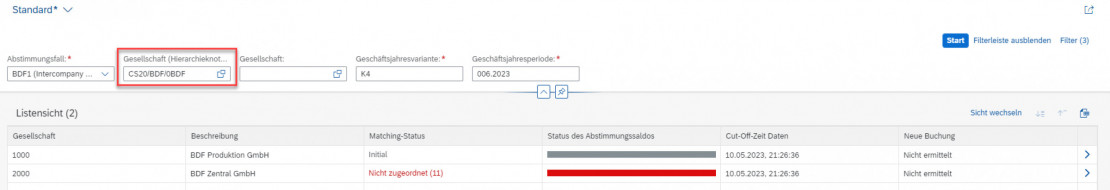

Reconciliation monitor & status display

The so-called reconciliation monitor then provides an overview of the reconciliation status of the companies at a glance. These can also be displayed in a hierarchy in order to recognize the dependencies within the group. For a clear presentation of the reconciliation results, however, a reconciliation case must first be defined here. The subdivision of the status into gray, red or green is based on tolerance amounts defined in advance.