16.11.2023

SAP FSCM Credit Management replaces FI-AR Credit Management

With the changeover to SAP S/4HANA, the previous FI-AR will be replaced by Credit Management as part of Financial Supply Chain Management.

What is behind it? What are the benefits?

In day-to-day business, the creditworthiness of a business partner is of central importance, as it provides information on whether and with what probability an invoice will be paid or not. In order to minimise the individual default risk from a business relationship, it is advisable to include internal and external information about a partner in your decisions.

Specifically, this could be:

- Average utilisation / exceeding of payment terms

- Average amount of outstanding amounts

- Data from external service providers such as Creditreform or SCHUFA

With Credit Management, which is part of Financial Supply Chain Management, SAP offers a processing option in S/4HANA to form an overall impression of the customer from the aforementioned information. This can then be used to optimise the business relationship and minimise the risk of default, e.g. by setting individual payment targets or agreeing advance payment for less solvent partners.

Advantages of credit management in S/4HANA at a glance:

- Minimisation of payment defaults

- Focus on reliable and solvent business partners

- Efficient and automated credit decisions

- Automated calculation of credit rating, risk class and credit limit

- Integration of external information systems, e.g. Creditreform and SCHUFA

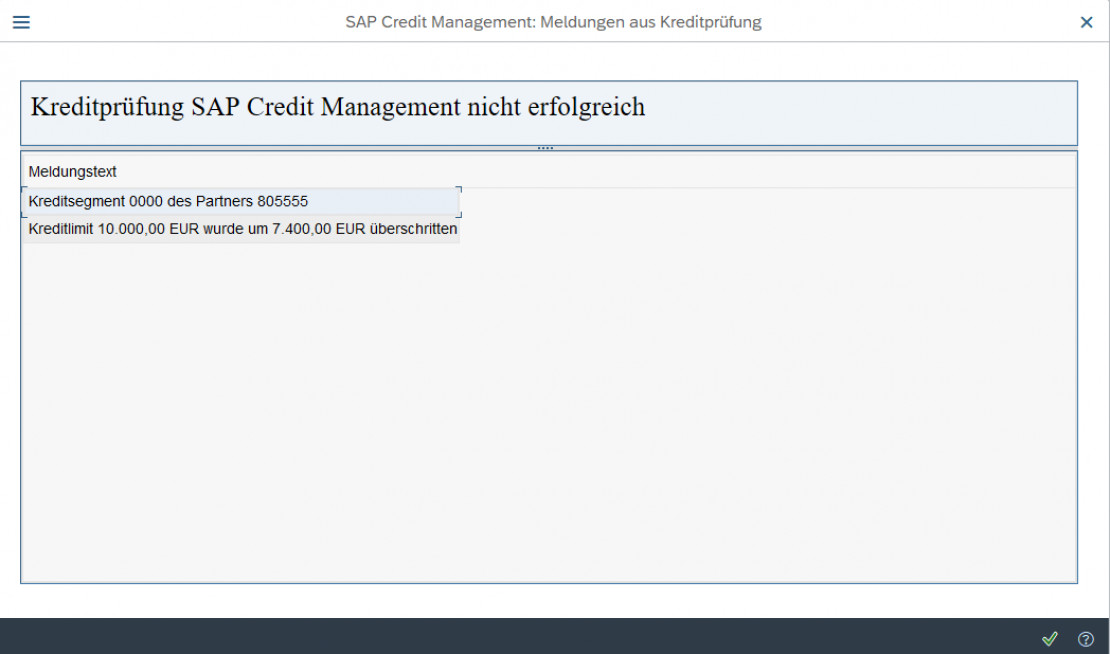

An important component of credit management is the credit line. This can be understood as the maximum amount of all outstanding receivables from a business partner. Its amount can be derived automatically in S/4HANA from the internal and external information mentioned at the beginning or determined manually. The line means that every time a new sales order is created, the system checks whether the order value of the sales order still fits into the credit line or not. If not, a warning appears in the sales employee's input screen:

In customizing, you can specify whether this should be a warning that can be acknowledged via a tick (bottom right) or whether the warning should lead to the customer order being cancelled. Now, of course, a scenario can occur in which the sales employee knows that further orders will follow. This could result in the credit line being further exceeded. In this case, the employee can request an increase in the line via case management. This increase would then have to be authorised by a line manager or a credit officer. These hierarchies can be defined depending on the organisational structure of a company.

In addition to the operational design of processes, Credit Management offers an analysis and reporting option with the Fiori app "Utilisation of credit limit". The data obtained from this can be used, for example, to evaluate a business relationship or as a basis for discussion with the customer about their outstanding receivables.

In conclusion, it can be said that with Credit Management, SAP offers an opportunity for the efficient use of creditworthiness data (internal and external) and its use in day-to-day business operations in order to minimise the individual default risk within a business relationship. As with many other processes, Credit Management can also be customised and used to suit the reality of a company's life.