09.05.2022

Inhouse Cash

The prevailing challenges of cash and liquidity management with regard to group-wide payment transactions have been a major challenge for national and international companies for years. A lack of overview of the liquidity situation within the group structures, the mass of decentralised bank accounts used by subsidiaries, insufficient central cash visibility coupled with high group-wide costs are prompting the search for digital solutions.

The benefits of an in-house bank

The introduction of an in-house bank with SAP Inhouse Cash, including the creation of a payment factory, enables the optimisation of group-wide internal and external payment processes. All payment information is available in a central SAP system. This ensures continuous netting of intercompany payments between the Group companies.

The centralised control of the in-house bank enables a concrete overview of all pending payments with the option of using payments with exact value dates or discounts, for example. Furthermore, the number of payments to external business partners can be greatly optimised by optimising the payment processes.

Savings opportunities through the reduction of external bank accounts not only offer a positive monetary effect, but also the synergy effects generated, e.g. in relation to the reduction of cash management-relevant cash movements, have a correspondingly positive impact on day-to-day operations. The early influence of movements relevant to the in-house bank on daily planning can strengthen the optimisation of liquid funds.

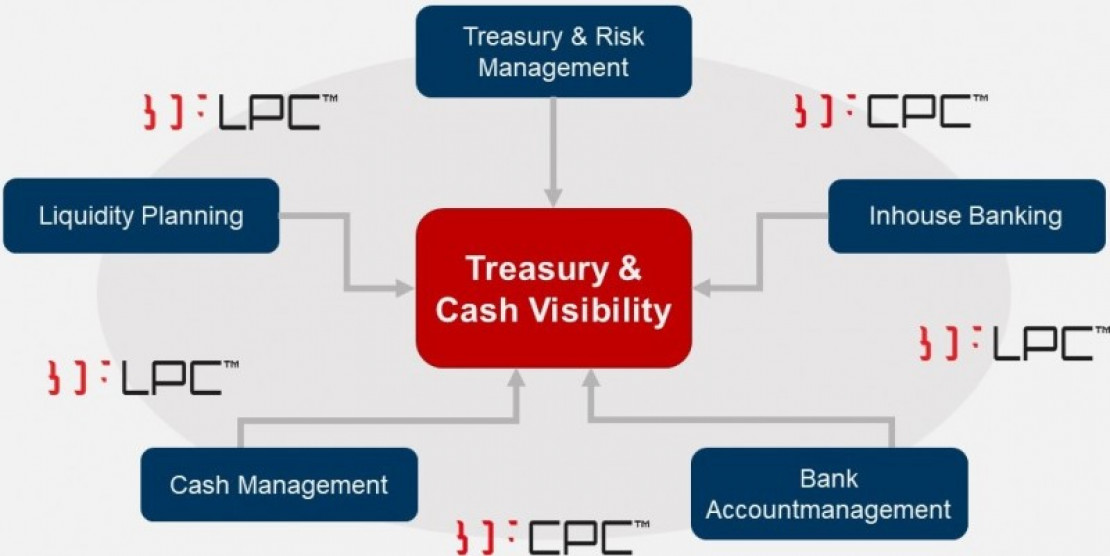

Cash visibility – the central point

The aim of a forward-looking company must be to utilise all existing synergy effects around the core objective of CASH VISIBILITY. Especially in times of the prevailing S/4 HANA transformations, the focus should be on Group-wide treasury processes. An isolated view is not advisable and leads to opposing activities with regard to the utilisation of synergy effects. The process-related end-to-end view in relation to cross-module processes is considered a success factor.

For BDF, the implementation of SAP Inhouse Cash is primarily focussed on the core objective of our customers. Taking into account processes that are as standardised and automated as possible, BDF stands for compliance with secure group-wide payment processes, as well as for a solution-oriented and customer-specific approach.