27.01.2026

The Future of Invoice Processing

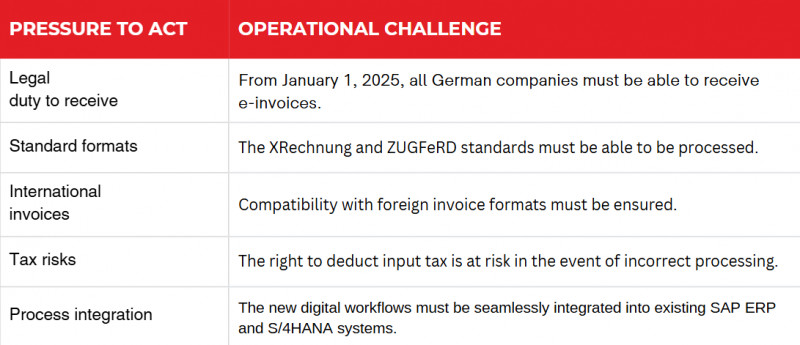

The digitization of accounting is no longer optional, but mandatory. Since January 1, 2025, all companies in Germany must be able to receive electronic invoices. This legal change, driven by the Growth Opportunities Act and the EU initiative “VAT in the Digital Age” (ViDA), presents CFOs, finance managers, and controlling managers with the urgent challenge of making their processes future-proof.

The challenge: Between legal constraints and operational uncertainty

The introduction of mandatory e-billing is more than just a formal change; it is a fundamental intervention in established financial processes. While the obligation to send e-bills will not take full effect until the end of 2026, the obligation to receive them from 2025 onwards is forcing companies to take immediate action. The uncertainty in finance departments is palpable:

- Are standardized formats such as XRechnung and ZUGFeRD also sufficient for international invoices?

- How can complex issues such as collective invoices or special sub-items be represented?

- And what are the tax consequences if an e-invoice cannot be processed correctly and the input tax deduction is at risk?

The solution: Strategic synergy from process consulting and technology

To meet these challenges, it is not enough to consider technology and processes in isolation. Instead, an integrated strategy is needed that combines expert process consulting with powerful software. The partnership between BDF EXPERTS and xSuite offers just such a synergy. While BDF EXPERTS ensures in-depth analysis and optimization of existing financial processes and their seamless integration into the SAP landscape, xSuite provides the technological basis for legally compliant and highly efficient automation of incoming invoice processing.

At the heart of this solution is the xSuite eDNA (electronic Document Network Adapter) in combination with xSuite Invoice. The eDNA acts as a central data hub that receives e-invoices in standard formats such as XRechnung or the hybrid ZUGFeRD format, validates them, and automatically prepares them for further processing in the SAP system. The ZUGFeRD format, which combines a PDF view with a structured XML data record, enables a smooth migration from PDF-based to fully automated processes.

After receiving and converting the invoice data, the solution automatically compares it with the master and transaction data in SAP ERP or S/4HANA. Error-free documents can thus be posted directly without manual intervention, while a digital approval workflow is started in the event of discrepancies. For outgoing invoices, an SAP add-on offers the option of sending invoices directly from the system in the required e-invoice formats via channels such as Peppol.

The added value for your company: More than just compliance

The introduction of an automated e-invoicing solution goes far beyond simply meeting legal requirements. It is a strategic lever for optimizing overall financial management.

- Optimized cash flow management: Early and transparent recording of all liabilities enables precise liquidity control. The finance department can optimize payment dates to maximize cash discounts and improve cash flow.

- Significant process cost savings: Manual intervention is drastically reduced by automating validation, reconciliation, and posting. Time-consuming clarification processes and physical archiving are eliminated, resulting in direct cost savings in the accounts payable area.

- Guaranteed legal certainty: Responsibility for compliance with complex and changing legal requirements is outsourced to the specialized solution provider. This relieves the burden on internal specialist and IT departments and minimizes compliance risks.

- Future-proofing: A specialized solution ensures that future legal changes, new formats, and transmission channels are supported in a timely manner and without internal project effort.

Conclusion: Act now and secure a decisive competitive advantage

The mandatory introduction of e-invoicing is a turning point for finance and accounting. Companies that act proactively now and opt for an integrated solution combining process consulting and intelligent automation will not only meet legal requirements but also take their financial processes to a new level of efficiency. The combination of BDF EXPERTS' SAP process expertise and xSuite's technological strength offers a clear path to fully automated and future-proof invoice processing.

Don't wait until legal pressure forces you to act. Take an active role in shaping the digital transformation of your accounting department and secure sustainable competitive advantages.