26.10.2023

E-Invoicing is coming to Germany

In its coalition negotiations at the end of 2021, the German government agreed on the mandatory introduction of so-called E-Invoicing in the B2B sector and is now actively pushing ahead with its implementation. The introduction is planned for 01.01.2025.

Apart from detailed questions that still need to be clarified, the following scopes are already clear:

- The first step will affect all companies based in Germany as well as foreign companies with a location in Germany. This means that all deliveries of goods and services with a connection to Germany must be invoiced via E-Invoice.

- The standardised invoice format is being developed based on the CEN standard EN 16931. All other invoice formats, e.g. on paper or as .pdf, lose their legal validity.

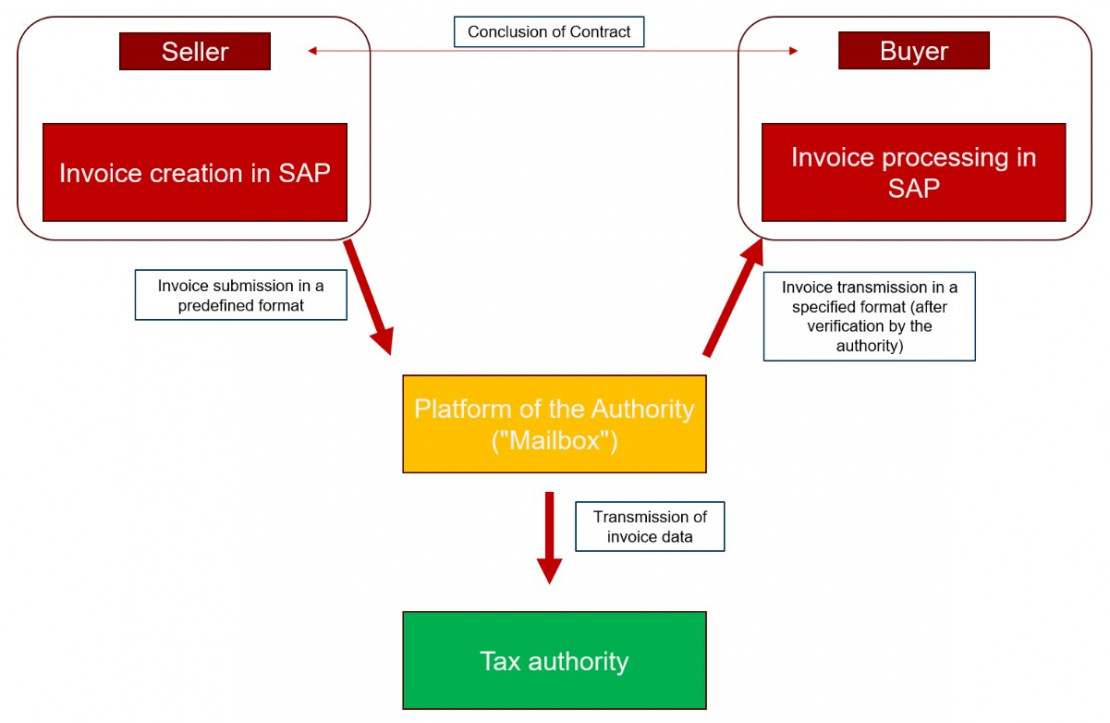

- A federal authority serves as a "mailbox": invoices between companies are sent via a standardised platform provided by a federal authority. The platform serves not only as an interface, but also as a validation tool that checks the invoices for completeness and accuracy. This check is to take place in real time.

The Confederation likes to formulate the objective that E-Invoices can be processed in companies' ERP systems without media discontinuity. This undoubtedly leads to faster and more efficient invoice creation and processing. However, the legislator is also pursuing its own interests: To prevent VAT fraud by companies and thus increase tax revenue in times of empty coffers.

It is regrettable that many European countries have already introduced E-Invoicing or are planning to do so. Instead of agreeing on a standardised approach at EU level, each country is currently imposing its own national standards. However, the Commission is aware of the problem and is striving for harmonisation. It can therefore be assumed that implementation on 1 January 2025 will not be enough and that it will remain a dynamic process of implementation and change for years to come.

Italy is considered a pioneer in the use of E-Invoices throughout Europe. The first stage became mandatory for companies as early as 1 January 2019, with a tightening and expansion activated on 1 January 2022. Experience has shown that it is possible to implement E-Invoice in your SAP system without external software.